Every year, the U.S. Census Bureau publishes estimates on state and local revenue and spending. The most recent estimate is for 2017. The top five states in per capita state and local revenue collection, including federal transfer payments to state and local government (mostly Medicaid) are New York, Alaska, Wyoming, California, and Hawaii.

In the case of Alaska and Wyoming—both energy-rich but sparsely populated states—collect significant revenue by taxing energy commodities. New York, California, Hawaii, on the other hand, are high cost of living states with high taxes.

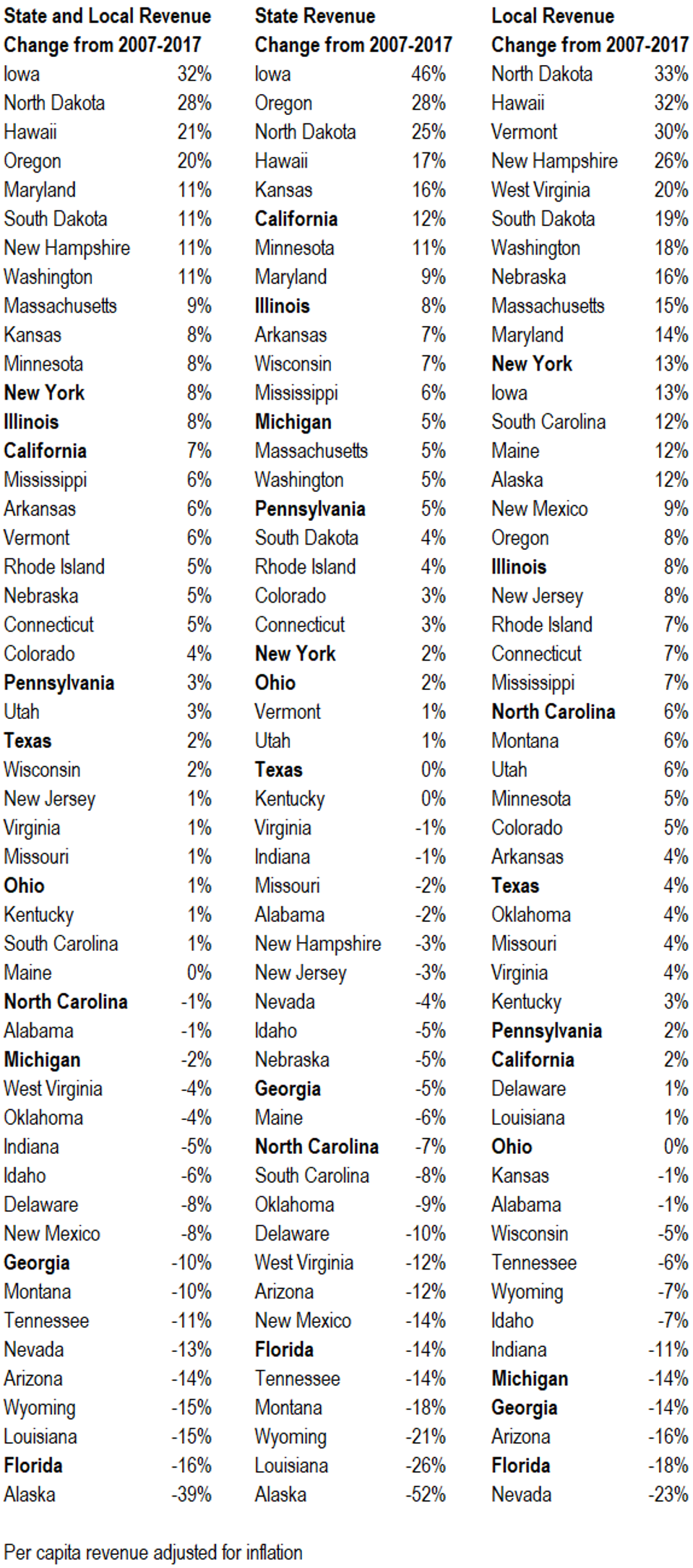

But where have taxes increased the most over the past 10 years, from 2007, on the eve of the last recession, to 2017? After accounting for population growth, growth in government revenue can be looked in three general categories: the percentage change in state and local revenue, excluding federal funds; the percentage change in a state’s own revenue, and; the percent change in local government’s own revenue.

Examining the data this way produces some interesting results. The top five states for increased inflation-adjusted per capita government revenue at the state and local level, excluding federal funds are Iowa, North Dakota, Hawaii, Oregon, and Maryland. North Dakota’s huge boom in revenue can be explained by the oil shale fracking revolution that took place there in recent years while Maryland likely benefited from the continued expansion of high-paying federal jobs tied to Washington, D.C.

At the other end of the scale, Alaska, Florida, Louisiana, Wyoming, and Arizona saw the greatest drop in state and local revenue. Alaska, Louisiana and Wyoming can largely be explained by the changing fortune in the energy markets, upon which they rely heavily for excise taxes.

Among the 10 most-populous states with diversified economies, highlighted in bold in the table below, the expected big-government-loving states increased revenue by the greatest pace, with New York, Illinois, and California leading the way with the largest boost in per capita state and local revenues. Texas saw per capita state and local revenue increase 2% over the 10 years, fifth out of the 10 big states. Florida experienced the largest decline in state collections, 16%, as the legislature has reduced taxes every session since 2010.

State-only revenues went up the most in California, Illinois, and Michigan among the ten most-populous states. Texas state-only per capita revenue was flat, at 0%, from 2007 to 2017. Florida’s state-only revenue declined 14%.

Local government revenue changed over the decade showed some surprising results. Mostly based on property taxes, though in New York’s case, New York City has several unique local taxes (including an income tax), local governments tend to have a lot of flexibility in raising revenue. California is one exception, with Proposition 13, passed in 1978—and up on the ballot to be partially dismantled this year—caps property taxes at 1% of the sales price of the property with appraised values rising no more than 2% per year. New York is again No. 1 in increased revenue, followed by Illinois, North Carolina, and Texas.