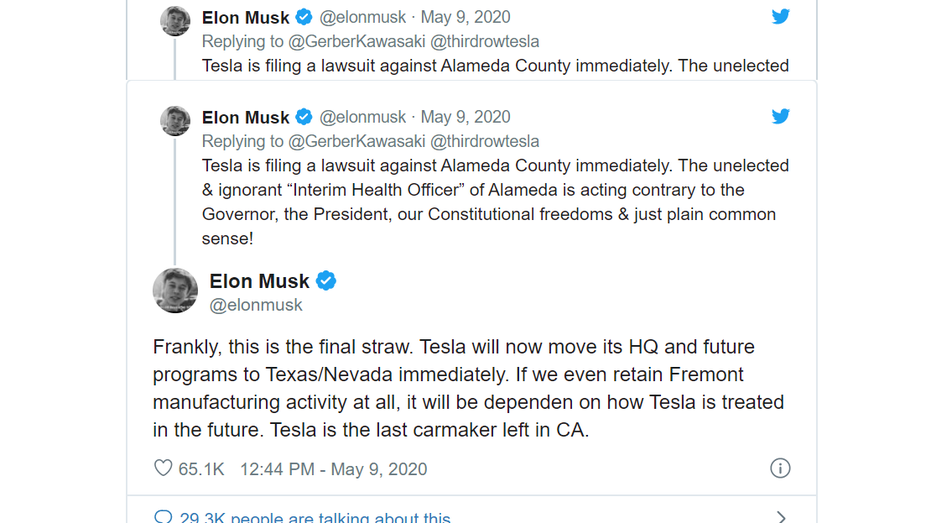

When, on May 9, Tesla CEO Elon Musk registered his frustration, via Twitter, over California’s COVID restrictions making it impossible to build cars, he wrote, “Frankly, this is the final straw. Tesla will now move its HQ and future programs to Texas/Nevada immediately.” He then added, “Tesla is the last carmaker left in CA.”

Musk’s threat to move to Texas was immediately discounted as empty, a mere hardball negotiation tactic with a state that has become notoriously anti-business. Unimpressed with the 10,000 jobs Tesla created in California, a State Assemblymember from San Diego quickly tweeted an expletive at Musk, in effect, telling him to go ahead and leave.

But now, contrary to expectations, things are getting real.

Tesla is said to be in negotiation with Travis County, Texas, home to the state capital, Austin, for property tax abatements on what is said to be up to a $25 billion investment bringing up to 30,000 jobs to the region. Since Texas collects most of its taxes through property taxes, abatements are often offered as an incentive for industry to locate in the state and can be worth millions.

The proposed Tesla gigafactory in Austin would build the company’s new Cybertruck electric pickup and serve as a second site to build the Model Y SUV.

Musk’s SpaceX already has a presence in Texas with its Rocket Development and Test Facility in McGregor.

The negotiations are serious enough that the United Autoworkers Union (UAW), and other allied unions, are pressuring the left-leaning Travis County Commissioners Court to make any tax abatements contingent on an agreement by Tesla to unionize its workforce. While Texas is a right-to-work state, localities can, in effect, override state law by withholding tax incentives unless a business agrees to certain terms favorable to big labor.

Tesla has been locked in a legal battle with the UAW over the union’s attempt to organize the manufacturer’s flagship auto plant in Fremont, California.

Any attempt by Travis County politicians to increase labor costs and rules in exchange for tax incentives to move to the Austin area may make Musk think twice—and then consider alternative sites in the more conservatively governed counties adjacent to Austin. Williamson, Hays and Caldwell Counties are prime candidates for their access to infrastructure, lower land costs, lower property taxes and affordable housing for workers.

Regardless of whether Tesla’s gigafactory is located in Austin or nearby, Tesla’s move to Texas would cement Austin’s status as America’s premier technology manufacturing region. The manufacturing jobs would likely pay about $35 an hour, or $65,000 to $75,000 a year while the supporting engineering, software and administrative jobs would pay far more.

Back in California, another threat against Tesla and the state’s last auto manufacturing plant is rising: the government’s COVID lockdowns have hammered the state budget, going from a surplus to a $54.3 billion shortfall, 46 percent higher than it was at the peak of the Great Recession.

This has led California lawmakers to consider a series of heavy tax increases to close the deficit. On top of that, voters will consider two ballot initiatives this November to hike property taxes on commercial properties up to $12.5 billion annually.

This would increase property taxes in California by 20 percent. This property tax hike, if approved, would significantly increase the tax burden for Tesla’s factory in Fremont and for other businesses, accelerating the business exodus out of the state.

Lastly, business analysts estimate that Telsa, and other firms, can save 32 percent of their operating costs by moving out of California, due to lower tax, land, labor, energy, and regulatory compliance costs. And, with news that Tesla’s Model 3 sales plunged 37 percent in April and May in California, their most important U.S. market, likely due to the government-imposed shutdown of manufacturing due to COVID-19, Musk is under even greater pressure to cut costs—a move to Texas may be just what the shareholders ordered.