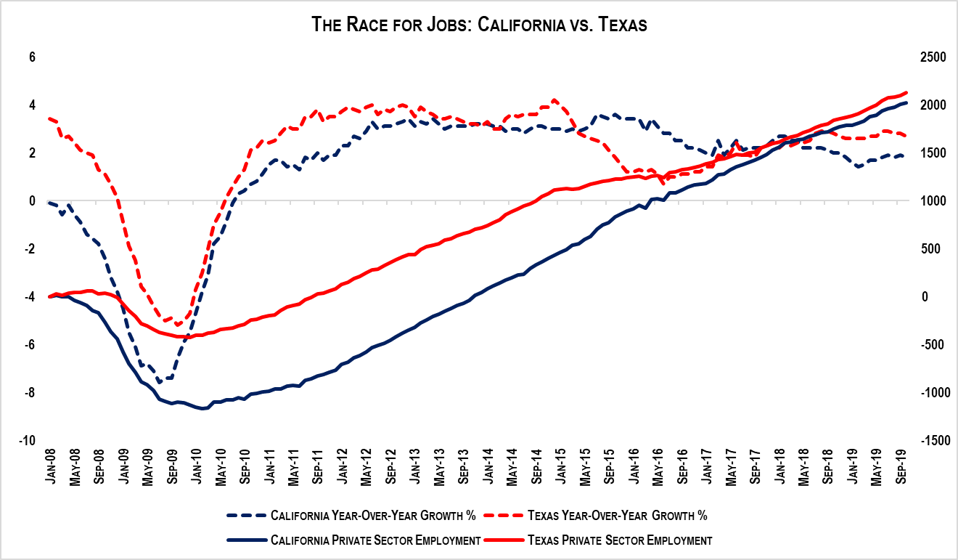

California’s population is 38% larger than Texas’, but since 2008, Texas has added about 100,000 … [+]

TEXAS PUBLIC POLICY FOUNDATION, DATA FROM THE U.S. BUREAU OF LABOR STATISTICS

Charles Schwab (NYSE: SCHW), the San Francisco-based financial services firm that pioneered low-cost stock trades, is moving to Texas. The announcement follows news yesterday that Charles Schwab will acquire TD Ameritrade for $26 billion.

Schwab will move its headquarters to Westlake, a suburb of Dallas-Fort Worth. The shift to Texas was telegraphed with Schwab’s increasing presence in the area over the years, with the firm already readying to double its Westlake workforce to 2,600. Ameritrade also has a large footprint in the area.

In a separate transaction, Schwab is picking up the brokerage assets of San Antonio-based USAA for $1.8 billion.

Regarding the move out of California, Schwab chairman and founder Charles Schwab noted California’s high taxes factored in the decision while observing, “…the costs of doing business here are so much higher than some other place.”

Mr. Schwab was likely too polite to mention that his employees were much less likely to experience electric black outs in Texas, or step in human waste and used needles on the streets of Westlake, as opposed to San Francisco.

In 2014, another made-in-California company, Occidental Petroleum (NYSE: OXY), announced it was spinning off its California assets and moving to Houston. One of America’s largest oil companies, Occidental panned California’s regulatory environment, with a spokesperson saying that, “…we exited low-margin, low-return businesses… we spun off California.”

That spin-off, California Resources Corp. (NYSE: CRC), had a market capitalization of $14 billion with 8,000 employees five years ago. Now, due to California’s increasingly hostile, anti-hydrocarbon policies, California Resources Corp. has a market capitalization of $310 million and employs 1,250 people in California. Its value has plummeted 98% since the spin off.

Corporate moves out of California, both the large ones that make news and the thousands of family-owned businesses that rarely make the headlines, add up.

Comparing America’s two-most populous states’ private sector employment data from January 2008, through the recession, to October 2019, is illuminating. Job growth is one major macroeconomic yardstick. California added 2.02 million jobs compared to Texas at 2.12 million. Based on the job growth alone, one might think California was holding its own. But California’s population was an estimated 39.6 million people in 2018 while Texas has 28.7 million. The percentage increase in private sector employment since January 2008 is stark: California saw job growth of 15.6%, while Texas saw 24.1%, for proportionately 54.1% higher job growth in Texas.

California is a large state with a varied economy, strong ties to the Pacific Rim and a vibrant tech economy. That understood, it cannot continue its anti-growth policies without expecting more high profile corporate exits from the Golden State.